Best Student Loans For 2025

In this Best Student Loans for 2025 Guide, we will discuss loan benefits, loan tips, and the best loan strategies that will lead you to the proper funding for your academic journey.

Continue...Choosing the right card will protect your travel funds and give you more freedom to spend on unforgettable experiences. Let's explore the best options and debit card tips to make your travels smooth and stress-free.

View Details

When you spot bank fees on your statement, you probably wonder, What caused these charges? You're not alone! While debit cards are convenient, that doesn't mean your spending will be fee-free. These cards can come with small, sneaky charges that add up over time. But don't worry! We're here to uncover these hidden fees and arm you with debit card tips to help keep those charges at bay.

View Details

Here are the best side hustles to boost your income—practical, profitable, and no fluff. Let’s get into the further details!

View Details

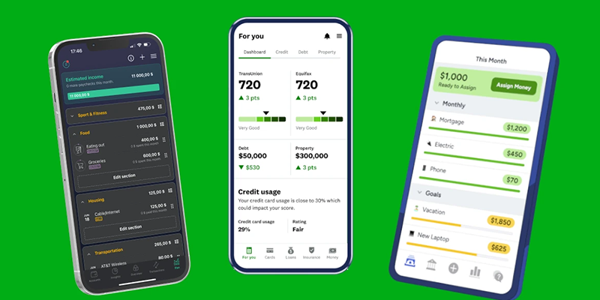

There's something for everyone, from budgeting tools to investment apps and savings trackers. This guide on the Best Personal Finance Apps for 2025 will help you navigate the top solutions to take control of your finances. Ready to maximize your financial potential?

View Details

How much should you save for your retirement? Are you ahead of the game, or are you falling behind? Many people deride retirement planning because they think they have enough time. The truth is that waiting can cost you thousands; the earlier you start, the easier it becomes.

View Details

Welcome to the How to Pay off Debt Quickly guide, where we'll turn your debt-free dreams into reality. Ready to kick those balances to the curb and take back control of your money? Let's make it happen.

View Details

In this Best Student Loans for 2025 Guide, we will discuss loan benefits, loan tips, and the best loan strategies that will lead you to the proper funding for your academic journey.

Continue...Let us enter the most powerful loan strategy on how lenders can practically throw money at you:

Continue...This Debt Consolidation Loans guide will walk you through the refinancing process, helping you choose the right loan to regain control of your finances.

Continue...The benefits of payday loans are real, but they develop into monetary disasters when you fail to approach these loans cautiously. This piece analyzes payday loans to determine their value compared to the associated risks.

Continue...You need the right game plan to secure the best loan strategies that work in your favour. From interest rates to repayment terms, this guide will walk you through the essentials so you don’t get stuck with a bad deal.

Continue...Let’s break down the best loan strategies and explore the top ways to get approved, even with bad credit.

Continue...Home upgrades aren’t just about aesthetics—they’re about crafting a space that sings to your soul while boosting your property’s value. But let’s be real: footing the bill upfront isn’t always an option. That’s where Home improvement loans swoop in like a caped crusader, offering you the cash to renovate now and pay later. Whether it’s a leaky roof begging for repair or a bathroom screaming for a modern facelift, the right loan can turn “someday” into “today.”

Continue...Think of it like shopping for a gemstone: You wouldn't grab the first shiny rock without checking its cut, clarity, and cost, right? Loans are no different. Lower payments mean less Stress and more money for life's little luxuries. Let's break it down with flair and finesse.

Continue...